Penalty for not registering under GST. The fees and charges recovered for Special Service Request SSR such as excess baggage cancellation modification etc are inclusive of GST at the applicable rate.

Gst Portal Provides Simple To Use Offline Utility For Uploading Invoice Data And Other Records For Creating Gstr 1 Accounting And Finance Worksheets Offline

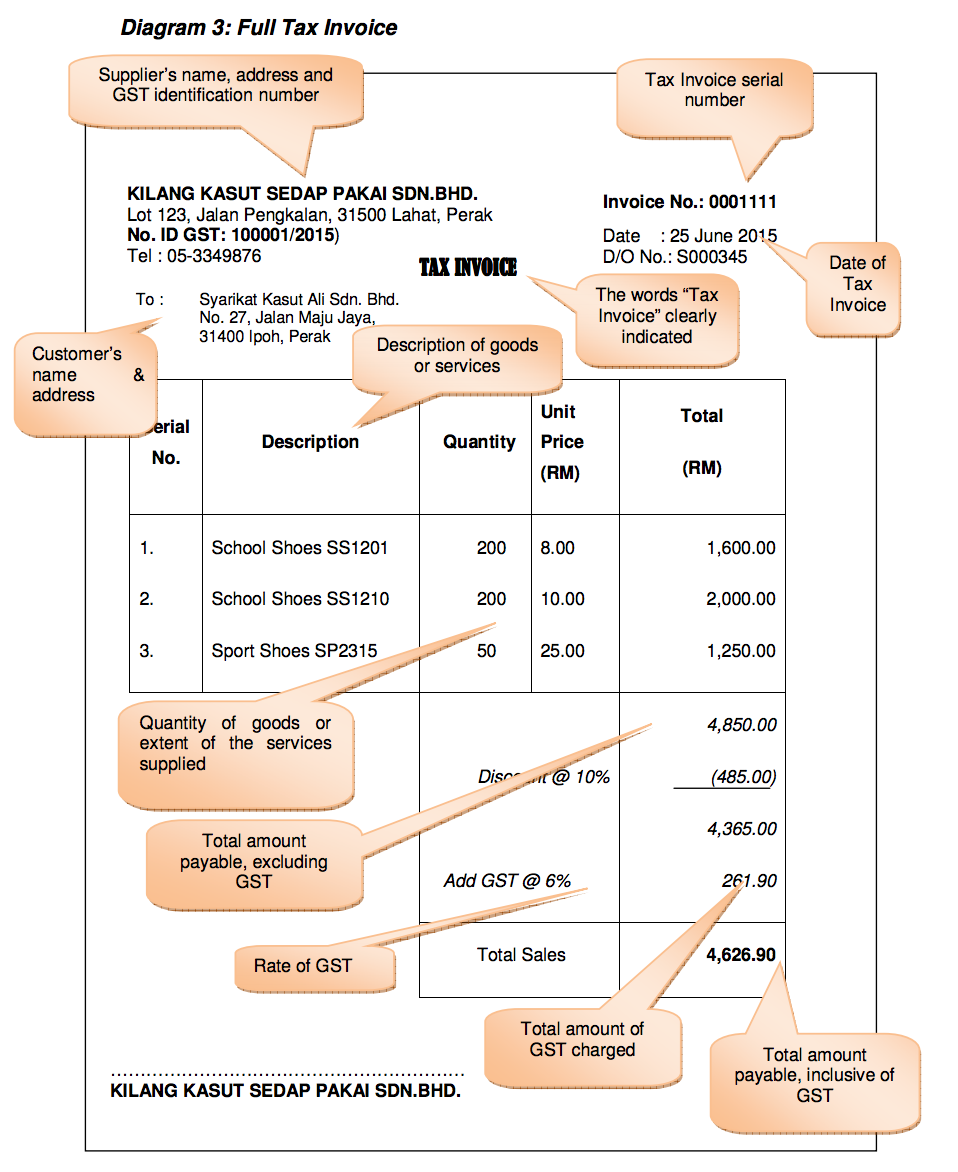

Tax invoices sets out the information requirements for a tax invoice in more detail.

. Some of the main uses of GSTIN are mentioned below. Penalty 100 of the tax due or Rs. Earlier the GST.

GSTIN or other information can be entered only at the time of the initial booking before the PNR is generated. A 15-digit distinctive code that is provided to every taxpayer is the GSTIN. Now there are different types of invoices that are issued under the GST law.

This is because the tax invoice not only enables the seller to collect payments but also avail input tax credit under GST regime. It was developed by the World Customs Organization. Goods and Services Tax the name for the value-added tax in several jurisdictions.

The seller is registered for GST and charges John 1100 including 100 GST. To account for GST requirements the following tax rates are available in Xero. In the case of individuals taxation is determined on whether a person is a Singapore tax resident or notIn order to be deemed as.

10000 whichever is higher. A tax invoice is the invoice created by a GST registered business owner when he sells taxable goods and services. According to the Singapore tax code taxation in the city-state is made based on the resident status of payersThis principle applies to both natural persons and companies and implies several aspects.

Service Accounting Codes SAC is a unique. Each product has a unique HSN code which must be mentioned on the invoice. The HSN code is a 6-digit uniform code that classifies 5000 products and is accepted worldwide.

GST is a destination based tax and levied at a single point at the time of con sumption of goods or services by the ultimate consumer. 10000 -whichever is higher if the additional GST collected is not submitted with the govt Penalty for not issuing an invoice. When you add an account to the chart of accounts you can choose the tax rate.

John can claim a GST credit of 100 on his activity statement. 15 GST on Expenses. Tax base determination in Singapore.

If you supply or receive an invoice that only has a figure at a wine equalisation tax-goods services tax WEG label you need further information to claim GST credits and for it to be considered a valid tax invoice. The GST law makes it necessary for registered taxpayers to issue invoices for the sale of goods or services. GSTR 20131 Goods and services tax.

Each account has a default tax rate. By law every business and person is eligible to pay tax or a tax. The Goods and Service Tax GST Council has recommended hiking the GST rates on licensing services of recorded media to 18.

Tax invoice will be issued to the email address specified by you. 15 GST on Income. Signup for a Free Trial.

Penalty 100 of the tax due or Rs. The tax rate determines how Xero treats the transactions for GST purposes. 10000 whichever is higher.

John can also claim an amount that reflects the decline in value of the photocopier on his tax return. These depend on various. ClearTax GST Software simplifies GST Return Filing GST Invoices and provides Free Hands on GST Training to Tax Experts Businesses.

Income tax is the tax that the government takes out of income on the income of the people. GST is based on the principle of value added tax. Free Guide on GST and Income Tax.

Claim 100 tax. Tax invoices are mandatory for claiming Input Tax Credit. The GSTIN will be provided based on the state you live at and the PAN.

HSN code is used to classify goods to compute GST. Goods and services tax Australia Goods and Services Tax Canada Goods and Services Tax Hong Kong Goods and Services Tax India Goods and Services Tax Malaysia Goods and Services Tax New Zealand Goods and Services Tax Singapore. Penalty 100 of the tax due or Rs.

Taxable and non-taxable sales.

Tax Code Table Proline Documentation

Complete Sst System Setup Guideline Help

Yyc Advisors Recommended Gst Tax Code Listings For Supply Source Accounting Software Enhancement Towards Gst Compliance Revised As At 18 July 2016 By Customs Facebook

Deemed Supplies Scenarios Malaysia Gst Sap Blogs

Complete Sst System Setup Guideline Help

Deemed Supplies Scenarios Malaysia Gst Sap Blogs

Implementation Of Goods And Service Tax Gst In Malaysia Yyc Goods And Services Goods And Service Tax Malaysia

Abolition Of Gst And Transition To Sst In Malaysia Activpayroll

Complete Sst System Setup Guideline Help

Gst Tax Procedure Migration Taxinj To Taxinn For Procurement Process

Deemed Supplies Scenarios Malaysia Gst Sap Blogs

Import Goods That Have Gst Finance Dynamics 365 Microsoft Docs

![]()

Gst Goods And Services Tax Symbol Businessman Holds A Cube With Up And Down Icon Word Gst Beautiful White Background Copy Space Business And G Stock Photo Alamy

Non Deductible Tax Code Bl Sap Blogs

Basics Of Gst Tips To Prepare Gst Tax Invoice